The Closing Process

You have found the perfect property and your offer was excepted! Congratulations! Now all that is left is too close or “settle” the final details on the property.

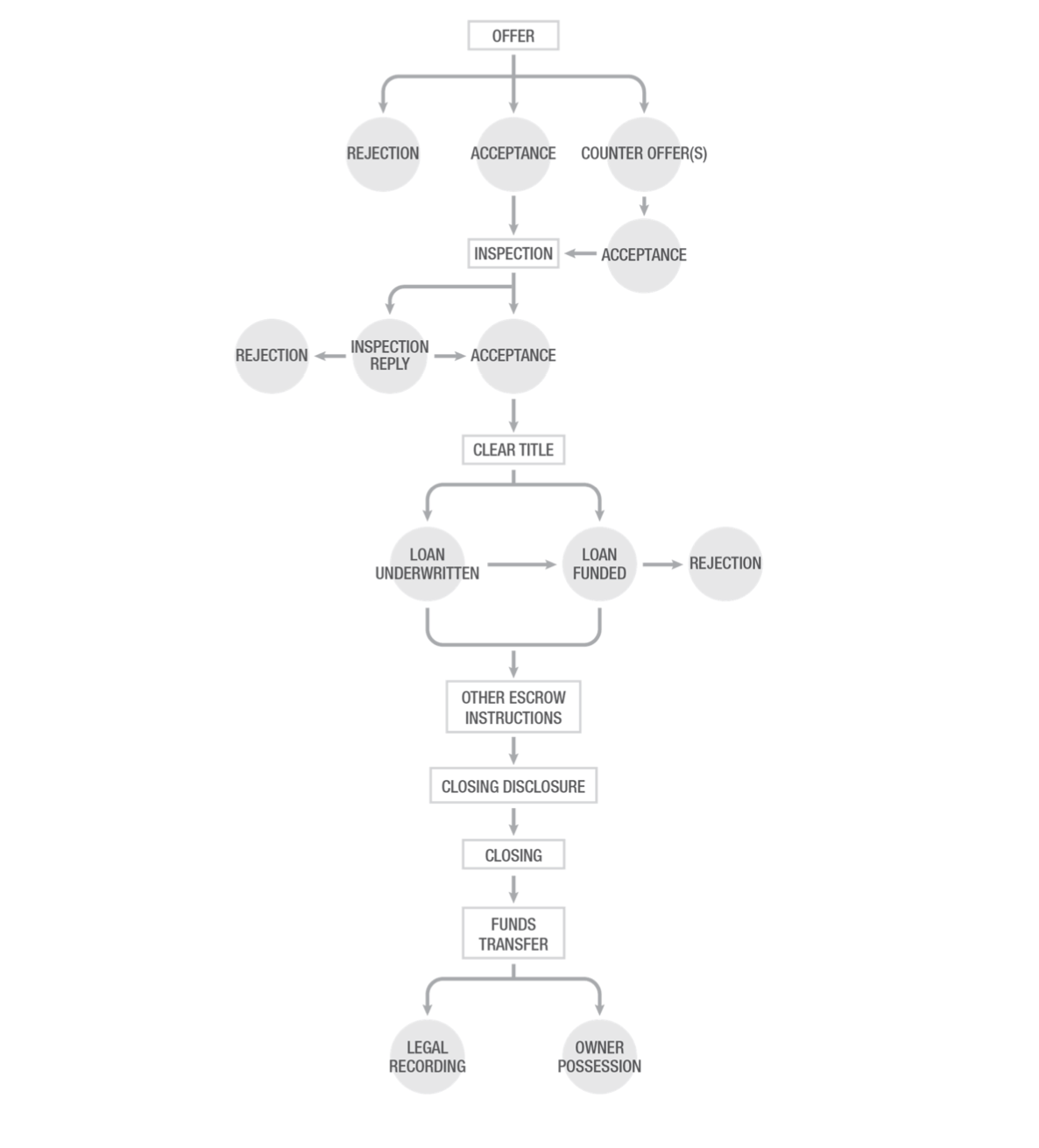

In the image below you are able to see the process of closing. It might not seem like a lot here but each individual circle has an abundance of details behind the scenes.

An overview of the steps in the graph above:

1.Offer: Contract proposal from the buyer received by the seller through their agent, extending terms, which if agreed, form the basis for a sales contract.

2.Acceptance: Seller and buyer accept all proposed (and counter proposed) terms and conditions and are ready to sign the contract and move toward closing.

3.Counteroffer(s): Seller’s amendments to the offer, creating an opportunity for further negotiations with the buyer. The buyer may reply.

4.Rejection: Seller decides not to pursue the offer further, or buyer rejects a seller’s counter - ending the negotiations.

5.Inspection: Buyer conducts all required or desired inspections - physical, environmental, etc. - and receives a report (if a professional inspector is used).

6.Inspection Reply: Buyer’s document itemizing desired improvements or repairs resulting from observations or tests performed during inspection.

7.Inspection Reply Acceptance or Rejection: Seller determines their response to the inspection reply and amends contract terms to reflect what they are, or are not, willing to do to comply with the buyer’s requests. This process, a further negotiation of the contract, continues until it is either totally resolved, or until the contract is rejected by either party.

8.Clear Title: Buyer and seller have an opportunity to review a preliminary report of title (local forms of this vary) that reflect whether any encumbrances, liens, or other issues have been discovered that might prevent the buyer from taking clear title to the seller’s property.

9.Loan Underwritten and Funded: While the buyer and their agent have lead responsibility here, the listing agent also has a responsibility to the seller to assure that the buyer’s loan is progressing with all due haste - and that it will fund for closing in a timely manner.

10.Other Escrow Instructions: Either or both parties may have given the title and or escrow company (in some states these two are one and the same) special instructions about disbursement of funds. Both agents have a responsibility to make sure any questions about the disbursement details are answered to avoid last-minute delays.

11.Closing Disclosure: The Closing Disclosure is federally-mandated; it is a five-page form that provides final details about the mortgage loan. It includes the loan terms, the projected monthly payments, and closing costs. The lender is required to provide the Closing Disclosure at least three business days before closing.

12.Closing: The final face-to-face meeting of the parties to conclude the transaction. Each party signs the required documentation with a title and or escrow officer present to oversee the signing process. Funds are presented by the buyer or the buyer’s lender to satisfy terms for the sale. The seller receives their proceeds from the sale.

13.Recordation and Possession: The transaction become part of the records of the local government entity with jurisdiction, and the transaction is complete. The buyer takes possession of the property that the seller has vacated, unless a seller carryover or buyer preoccupancy has been part of the contract.

The closing process includes the following parties/individuals:

-buyer(s)

-seller(s)

-other agents

-attorney (s)

-lender (loan officer, mortgage processor)

-members of your agent’s team

-closing/escrow company (closing officer, assistant)

-third parties (loss mitigation, relocation, estate, etc.)

-family or friends lending money to buyer for down payment

-market center staff (MCA, transaction coordinator, etc.)

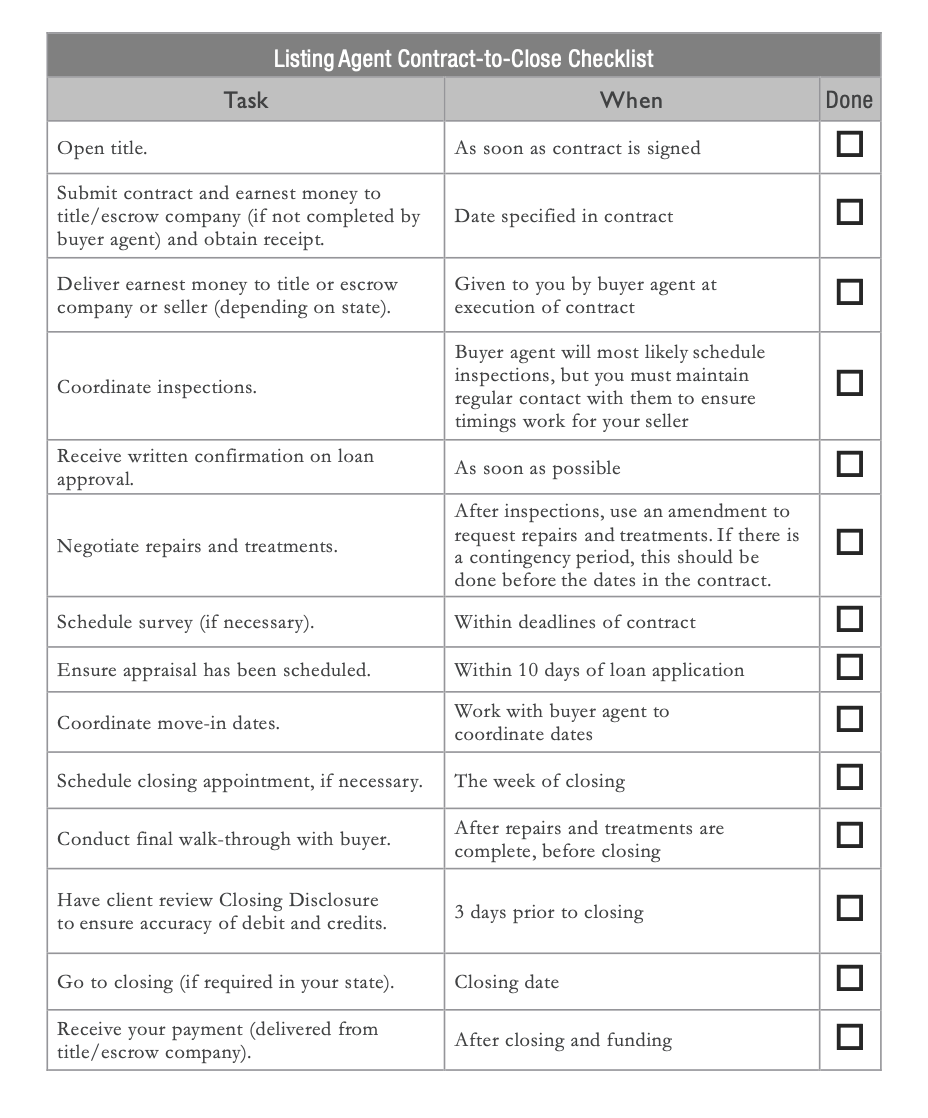

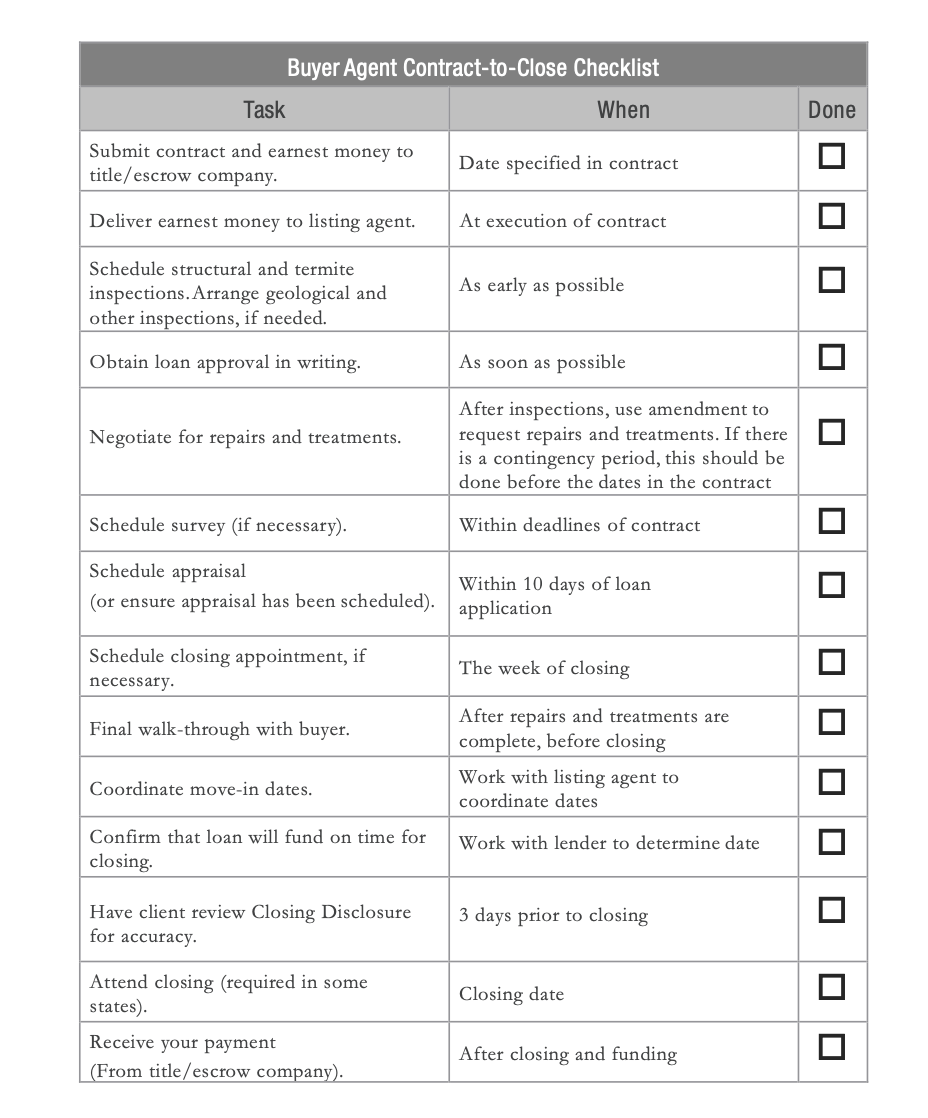

For the closing process it is key to have checklists or systems for pre close, closing, and post-close so that it makes the transaction go smoothly and each party can recognize their tasks. Below you are able to see a buyer agent checklist and a listing agent checklist.

We know there are a lot of moving parts during a closing but we are here to make sure that our buyers or sellers are prepared for the closing and that they understand the system and all of the information that is handled.

Some important dates to remember that happen during closing:

For Buyers:

-Effective Date

-Loan Application Deadline

-Inspection Deadline

-Loan Commitment Due

-Inspection Response

-Additional Escrow Date

-Termite Inspection

-Closing Date

For Sellers:

-Effective Date

-Closing Date

We also understand that you might not remember everything so it is always okay to ask questions or have us review certain details.

Want to know more about the closing process or looking to sell or buy a property in Arkansas. Let’s connect!

cassiewells.com | cassie@cassiewells.com | 501.993.1973